Tax season is fast approaching, and if you do your own taxes, H&R Block’s At Home Tax Prep software will help you with your filing. I don’t know about you, but the thought of filing just stresses me out. We are very blessed to have someone do our personal and business taxes for us, but I have heard doing them on your own can be a bear. So, to help you out, checkout the links below addressing topics many of you tax filers will face this year:

Tax season is fast approaching, and if you do your own taxes, H&R Block’s At Home Tax Prep software will help you with your filing. I don’t know about you, but the thought of filing just stresses me out. We are very blessed to have someone do our personal and business taxes for us, but I have heard doing them on your own can be a bear. So, to help you out, checkout the links below addressing topics many of you tax filers will face this year:

- Filing Taxes When You’re Unemployed – H&R Block – If you were unemployed in 2010, you can find out which tax deductions and tax credits can benefit you.

- Save Time and Money in 2011 with These 11 Tax Tips – 2011 tips include free 1040EZ filing, 2 percent pay raise, and unemployment

- Income Tax Deductions for Work-Related Expenses – H&R Block … – Learn to take advantage of income tax deductions for work-related expenses.

Now to the good part!

========================

GIVEAWAY DETAILS

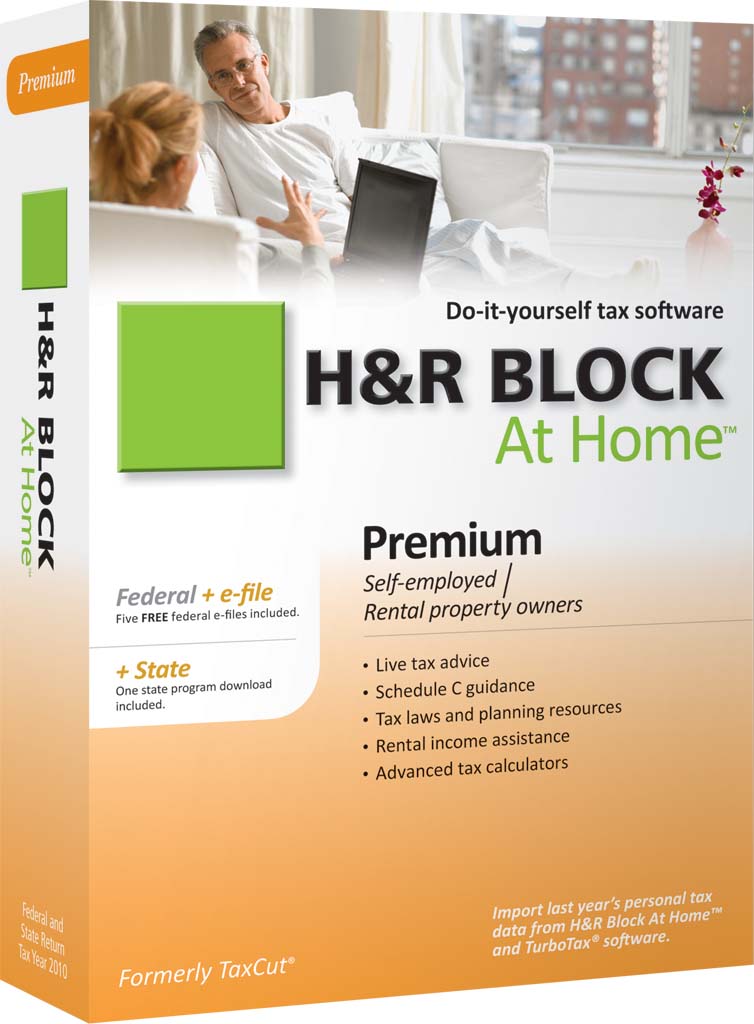

H&R Block is offering six Premium Version – At Home Tax Prep Software Licenses (a $64.95 value) to randomly selected winners. Winners will be announced on Tuesday, March 1, 2011.

Faithful Provisions Giveaway Disclosure: H&R Block sponsored this giveaway by providing me with six H&R Block Premium Version Software licenses to give away to a randomly selected winners. For more information about Faithful Provisions, please read my Disclosure Policy.

====================

HOW TO ENTER….

*One entry per person per method of entry per day. Be sure to enter a separate comment for each method of entry (one comment for Facebook, one comment for Twitter, etc.). This way you have a higher chance of winning.

**4 Entries per Person per Day

1. COMMENT: Leave a comment and tell me your tips for filing taxes.

2. NEWSLETTER SIGN-UP: Subscribe to my Email Newsletter – even if you already receive it, add an entry as a comment below!

3. TWITTER: Follow Faithful Provisions or H&R Block on Twitter – just copy and paste this message into your tweet

Hey! @FaithfulProv is giving away six @HRBlock At-Home Premium Version Software packages! Stop by to enter http://bit.ly/fnD9zP #giveaway

4. FACEBOOK: Follow Faithful Provisions or H&R Block on Facebook – just paste this message on your personal Facebook wall so your friends will see it.

Faithful Provisions.com is giving away six H&R Block Premium Version At-Home Software packages! Stop by to enter http://bit.ly/fnD9zP

====================

Giveaway ends Friday, February 25, 2011 at 10:00 pm CST. The winner will be drawn using Random.org. Winners will be notified via email and all winners will be posted on the Tuesday Giveaway Round-Up post.

Organized reciept filing system. Keep everything! Breathe, this too shall pass. Send the family out for the day while you do paperwork/forms. Eat chocolate to ease stress! Hahahaha…..

sounds great!

Make a file folder for the year and put anything tax related into it. When the day comes to file, pull out the folder and everything is ready to go!

I subscribe to the newsletter!

Be organized, and keep your files organized all year, so you can go back and pull out any paperwork you may need without having to hunt.

File early, do it yourself using good software, and keep all receipts, etc.

Work on them while kids are out or in bed.

Have wife do the taxes while I take the kids out.

email subscriber

Keep a file folder & put tax items in it throughout the year.

Subscribe to emails.

We keep a file folder with all our tax documents/charity receipts in it throughout the year so that when it is tax time we have everything we need. We usually use turbotax online.

email subscriber to your blog.

FB fan of your blog.

Organize your files and start early.

I subscribe to your emails.

Keeping great records

I keep a folder of stuff that I know I’m going to need for my taxes, than I just drop it all off to my CPA!

Follow both & tweet: http://twitter.com/#!/lkim496/status/39877387915247616

I check everything two or three times to make sure I’m not missing anything on taxes.

I am an email subscriber!

I keep a folder all year for tax stuff…after filing my taxes I take the copy of everything and file them in the cabinet. So basically…keeping track of receipts…and filing…

I tweeted! (CouponClipNMama)

I print a monthly statement each month. This helps tremendously when getting all of our small business items together for tax time. For years I would not do this, and spent a good few days printing everything. This has helped me cut my tax prep time. Would love a copy of this software, WE LOVE IT! I use it every year!!

If you have someone do your taxes use an accountant! We used a bookkeeper and have been aduited. He has to take no responsibility for his mistakes.

On your email list!

Don’t put everything in a box! Have a file system with folders to separate everything – you can find anything in seconds. Have an organizer in your purse to track mileage and put gas & food rcpts until you get back to the home office. Run a spreadsheet of monthly expenses (and be sure you have all bils & rcpts that will balance out). Have one folder to keep notes of “deductions you have heard about” so that you can see if you qualify at tax time – this way you won’t forget about them. Be sure to check to see if any upgrades you do on your home will qualify for government energy efficiency credits.

I let my hubby do it 🙂