One of my goals for 2011 is to teach my daughter the value of money. Recently, she took her first real steps in learning this lesson and I’m happy to report it went well. Through some chores and Bible verse memorization, she earned and saved up about $17.

We planned a trip to the bank to trade in her coins for cash. But first we helped her make decisions about how much to save, give and spend. My husband sat down with her and helped her count the money out (By the way, this was a great school activity to enforce why and how to count by 5’s and 10’s).

We planned a trip to the bank to trade in her coins for cash. But first we helped her make decisions about how much to save, give and spend. My husband sat down with her and helped her count the money out (By the way, this was a great school activity to enforce why and how to count by 5’s and 10’s).

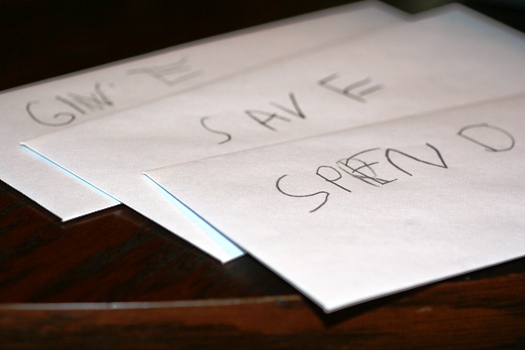

During that time he discussed the discipline of budgeting your money before you spend it. She even made her own SAVE, SPEND, and GIVE envelopes.

During that time he discussed the discipline of budgeting your money before you spend it. She even made her own SAVE, SPEND, and GIVE envelopes.

Let me back up a bit and tell you how we got here today.

A few weeks ago we used a Build-A-Bear Groupon I purchased that was about to expire. I had never been into Build-A-Bear before, but it was the perfect place to teach my daughter about making choices, because there are lots to make! Plus we had a blast doing it together – we turned it into a mother-daughter date. Before we went to the mall, we discussed how much money we had to spend and that it was her choice as to what was purchased. Basically, she had to decide if she wanted a more expensive animal with no clothes, or the least expensive one and her pick of some clothes.

It was really encouraging to see her go through the decision making process, asking questions and discovering what she really wanted. It was all about her making decisions and choices. When it was all said and done, she chose a less expensive animal and her favorite dress. Her new goal is to work up to purchasing accessories and more clothes for the doll on future trips to Build-A-Bear.

Although we talk about saving, giving and spending with her, she has learned a great deal about making these decisions through Dave Ramsey’s Financial Peace Jr. The Kids Super Pack has been fun for everyone in teaching her about money and making good decisions.

Since that initial purchase, we went back and she made her first purchase. Of the $17 saved, she set aside $10 for spending.

After answering some questions and talking it out, she chose an outfit which was on sale for her Build-A-Bear. Because it was on sale, she was able to purchase a full outfit and pay for the taxes (Yes, she is responsible for the entire purchase)!

After answering some questions and talking it out, she chose an outfit which was on sale for her Build-A-Bear. Because it was on sale, she was able to purchase a full outfit and pay for the taxes (Yes, she is responsible for the entire purchase)!

Here is the receipt. She saved $3.50 on her very first purchase — good girl! I am so proud. See me beaming here. 🙂

Here is the receipt. She saved $3.50 on her very first purchase — good girl! I am so proud. See me beaming here. 🙂

See her beaming here? Her first purchase, she earned it, managed her money and is now seeing the benefits of her good money management! I personally believe that items that you plan for purchasing are the most rewarding.

See her beaming here? Her first purchase, she earned it, managed her money and is now seeing the benefits of her good money management! I personally believe that items that you plan for purchasing are the most rewarding.

As we walked out of the mall, she said to me, “Now I want to save up so I can buy my brother a Build-A-Bear, I love mine so much, he will love one too.” My heart just melted, because, in teaching her to make choices for the things she wanted, instead of just buying it for her, I think she is starting to get the whole save, give and spend thing.

Are you looking for a little direction and encouragement to teach your children about money? Stay tuned, because on Monday I will be giving away ten Dave Ramsey Junior packs for my readers AND I will have a special discount purchase code for Faithful Provisions readers!

The “Some Financial Peace for the Kids” post is brought to you by Dave Ramsey Junior. You can find out more about kids and budgeting at Dave Ramsey or in the Faithful Provisions Budgeting Series .

So, tell me a little about how you teach your children the value of money? Share your experiences and tips for those of us who are just getting started and need a little inspiration.

I love the photo of your daughter and hubby – so sweet!

Love it! Money can be such a hard lesson to teach, but she seems to have picked up the lesson beautifully. So, what did she name her bear? 🙂

Lilly Bear

Unfortunately, we’ve been very lax in this area, but are doing the Dave Ramsey Debt Free plan right now.

I have read and heard so many good things about Dave Ramsey’s programs, I guess I will have save up to buy his program. With 4 blessings (one with special needs) savings is what we are all about (not to mention NEED!).

Thank you so much for sharing this post, it was such an encouragment … especially today!

PS… Your daughter is beautiful!

Thanks for reminding us to work with our own kids on money. I have always made my kids save most all the money they get as gifts but as they have gotten older (boys, 8 and 5) I do allow them to spend some. When they make their own money by either saving up or selling lemonade at my yard sales, I always make them take out 10% first for Jesus, then we talk about saving some and spending a little too. Because of Faithful Provisions getting me into couponing, my kids have watched a lot of what I do to save and help out when they see a coupon. Thanks Kelly for your ministry!

We bought these banks as Christmas presents for all 3 of our children. They have 3 separate compartments–save, spend, give (to church). They’ve loved this concrete example of putting their money away for each of these 3 things. My parents did something similar for me and my brothers growing up, and I’m so thankful for their instruction when I was young, which has set me on the path for giving, saving, spending since childhood. Excited to teach these same principles to my own children. Great post!

Here’s the link to the “My Giving Bank”…

http://www.christianbook.com/my-giving-bank/9789834502706/pd/502702?item_code=WW&netp_id=214014&event=ESRCN&view=details

Maybe when she’s a little older you can teach her how to get on craigslist or ebay to possibly get an even better value!

Our daughter has separate jars for spending, saving, tithe and giving (for special needs she hears about, over and above tithing). Whenever she receives money gifts or earns money, she divides it among those jars, according to percentages. Great math practice too!

How sweet! Love that bear. 😉

We are just now starting to teach our daughter the value of a dollar and how she should save and give. We just got her a savings account and she loves taking change to the bank to deposit! Thanks for the chance! 😀

AWW look at how proud she is! GREAT JOB! People underestimate the importance of teaching children financial responsibility. I was a nanny for 17yrs and have always found these types of lessons carry them a long way and makes life so much easier for them. Plus they have a lot of fun learning them. BRAVO!! It’s great to see such wonderful parenting : )

I would love one for my 5 year old daughter, she is already a saver. When the ice cream man comes by she says mom can you buy me an ice cream, and I tell her you have money, and she says I know mom but I want to save mine!!!! Learning early!!!!

We are starting to get are kids to budget & save. They are 5 & 6 yrs old. I am posting to hopefully find some suggestions for age appropriate chores and what they would be worth.

Need help teaching finances, thanks!

I have a 2 year old son and just started him on doing chores around the house. He has had a piggy bank since he was a baby that he put change in but now we added a spending jar and a giving jar to his shelve. We give him $0.25 for each chore he does that day. To make the math easy we used the percentages 40/40/20 (spending/saving/giving). He loves it. The chores we came up with were like helping feed our dogs, picking up his toys before his nap, picking up his toys before bed, unloading the silverware from the dishwasher, and helping to take out the trash. These are things he gets a commission for doing. Then he has chores that he does just because he is part of the family to help out. Like, helping dust by putting socks on his hands, helping sweep, helping mop, helping vacuum, helping to put up his clothes, he likes to help changes his sheets. It seems like alot but he doesn’t do it all everyday. He loves helping mommy and daddy because he likes to be as independent as possible. I even have hygiene in his chores like brushing his teeth, which I actually don’t have to force him to do. I hope these ideas help someone. I want to get the Monster pack but I just can’t afford it right now because me and my husband just started the Dave Ramsey program our self but we are doing the best we can with what we have.

Teaching kids about financial responsibility, as highlighted in Faithful Provisions, is essential for their future success and can be a rewarding experience for both parents and children. It reminds me of Heart Bookkeeping’s focus on helping small businesses manage their finances effectively, underscoring the importance of financial literacy from a young age. For more insights on bookkeeping and financial management, visit Heart Bookkeeping.