For more budgeting articles in this series, click HERE.

Budgeting Step Three: How to Create a Household Budget

The more determined you are to make budgeting work for you, the better off you’ll be. Now we approach the third step of budgeting: How to create a household budget. The first two steps in this crash course on budgeting have been to write down what you spent the previous month and, after looking at where your money is actually going, decide where you want it to go from here on out by determining your financial goals.

In this third step of the Budgeting 101 Series, I’ll give you a few tips on how to start putting together a budget (yes, the dreaded “b” word!).

Creating a Household Budget

Creating a household budget is pretty easy. There are certain things that are the same for every family. Everyone has necessities for living, for example, shelter/utilities, groceries, and clothing. Most people have debt they are paying down, whether it is car payments or credit card bills. Here are the steps you need to take as you begin writing your own personal household budget.

1. Write down all necessities first, the things that MUST get paid. Be sure to include items that get paid only quarterly or yearly. Our household necessities include: tithes, mortgage, utilities, insurance, and association fees. Be sure to include any monthly payments on cars, tuition, student loan payments, and credit card bills you may have.

2. Set a food budget. Once you have money set aside for all these things to be paid, you can see how much you have to work with for your grocery budget. (You might end up changing this after you complete number 3 below!)

3. Check your calendar for upcoming events, including doctor’s appointments, date nights, babysitters, event fees, weddings or birthday parties–anything you have scheduled on your calendar that will require money. I often forget about big ticket items that I need to include in my monthly budget. For example, one month, a $100 entrance fee for a marathon my husband entered took me by surprise! Then there are little things that come up out of the blue, like doctor appointments (which usually have prescriptions that need to be filled) and babysitters–it all adds up. Depending on how tight our budget is for the month, knowing about upcoming expenses helps me to determine whether we might just not use a babysitter one night or stay in for pizza rather than having a night out.

4. Buffer money. What’s buffer money? It’s having that little extra cushion in the budget that allows for the unexpected. There are always things that come up during any month that we don’t anticipate, so this is for small ticket items. Please don’t confuse buffer money with an emergency fund; we have an emergency fund for real emergencies. Buffer money is a dollar amount that we build into our budget for “extras” that we know will come up, but that we can’t think of at that time. It’s really like a safety net for all those extras.

4. “Zero” balance your budget. When you “zero” balance your budget, you are just being sure that you have “given every dollar a name,” as Dave Ramsey encourages us to do. You have everything allocated. If, after writing down all your expenses and needs for the month, you have a surplus, you can begin to allocate it to meet your financial goals and dreams. So, if your goal is to set up an emergency fund, you would put anything extra into that fund or split it with something off your “wish” list.

Ways to Stretch Your Budget

If find that you are at a deficit, or you can’t cover all your expenses each month, below are several ways to stretch your budget and cut down on your monthly expenses.

1. Research service providers: There are lots of businesses wanting to “bundle” things (internet, phone and TV). Take a look at these options–but be careful. Some are great, but some just end up costing you more, so be sure to research carefully. Try not to switch services or providers mid-month when there are usually pro-rated fees which will cost more than your monthly fee. Switch at the beginning of a billing cycle.

2. Review monthly statements: I never used to look at our phone, bank, or credit card statements. I just assumed they were correct. I have found more errors and false charges on items since I began being thorough. It’s easiest for me to just make a point of looking over them right before I sit down to do our monthly budget. Here’s a great example: Last month, I found two or three items we were being charged for on our home phone line that we didn’t order, and things we would never even use! When I called, the customer service representative told me that they randomly add new services to your charges, and it is the customers option to cancel, can you believe that?

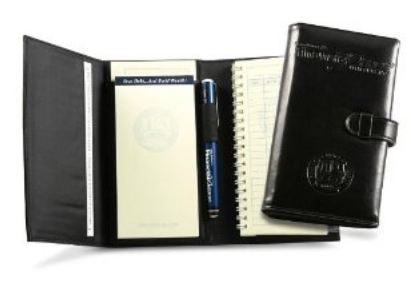

3. Use an envelope system: You can make your own envelope system, of course, or you can invest in this one (pictured above) from Dave Ramsey. It’s super nice–and you will actually want to use it!Dave Ramsey and other highly respected financial planners urge people to use an envelope system–which is simply going to cash only for your expenditures. When you are using cash that you can see, feel, and notice how full or empty your envelope is, it allows you to see the value of your money. Charging things on a credit card, or really, even using a debit card, doesn’t give you the up front and personal notification of how quickly or frivolously you are spending your money. You don’t tend to cut back on things that you really don’t need when you aren’t actually feeling the loss of the cash! At the beginning of the month, once my budget is set for things like my groceries and spending money, I put that money in an envelope. Watching that money slowly dwindle down makes me much more conscious of how I will spend it!

4. Shop around for insurance providers: There are usually lots of insurance providers looking for your business, and these days, they are willing to give you a bargain to switch over. We switched our home and auto insurance and found we could save almost half of what we were currently spending!

ACTION STEP: I have an easy to use, step-by-step, FREE budget worksheet HERE. It walks you through the process with pop-up instructions. Plus, it’s colorful and fun to use! Complete this worksheet before moving on.

What are things you do to cut down your monthly expenses? What tips do you have that helped you out when you first started budgeting? Please leave your comments here, my best and favorite tips always come from my readers!

Ready to move on? Find Step Four: Savings and Emergency Funds HERE.

If you are viewing this in a reader or via email, click here to see this posts comments.