When it comes to budgeting and saving money, everyone has a story. I learned to budget the hard way—out of necessity, and in many ways, out of sheer desperation. (That might be how you found your way here.) Believe me, I know what it’s like to feel desperate about your money situation. When I left the corporate world and my husband and I began to live on less than half of our former income, it called for me to get very creative, diligent, and serious about our budget. But when he got laid off several months later, I understood desperate. If we hadn’t had our budget in place, we would have had no direction, and no way to pick up the pieces.

When it comes to budgeting and saving money, everyone has a story. I learned to budget the hard way—out of necessity, and in many ways, out of sheer desperation. (That might be how you found your way here.) Believe me, I know what it’s like to feel desperate about your money situation. When I left the corporate world and my husband and I began to live on less than half of our former income, it called for me to get very creative, diligent, and serious about our budget. But when he got laid off several months later, I understood desperate. If we hadn’t had our budget in place, we would have had no direction, and no way to pick up the pieces.

How to Budget

Learning how to budget is easier than you think. I’ve got all the tools you need right here, along with the encouragement you need to stay on track. So much of learning any new habit begins with consistency. You will have to stretch outside your comfort zone to tackle budgeting. You will have to acquire some discipline. And you will have to get it in your head that budgeting is your new lifestyle. It’s something that my husband and I sit down and do at the beginning of every month. And you know what? I look forward to it.

“A budget is telling your money where to go instead of wondering where it went.” ~Dave Ramsey

I have learned to budget and to enjoy it because I know it brings me something that I didn’t have before: freedom. I am free from being desperate and worried about our finances because we are the ones who decide where our money is going every month. We’ve learned how to anticipate expenses and keep money tucked away to deal with them. And incredibly? Our budget not only allows us to live on the money we make—it allows us to give on the money we make. There is nothing better than knowing where you stand financially each month.

Here are three simple steps to budgeting:

- Find out how much you are spending. This can be accomplished by looking over last month’s bank statement. Where does your money go? Did you realize how much money you were spending?

- Decide where you want your money to go. Think of this as “re-directing” your financial focus. Determine some goals for your money. Your number one goal should be to get rid of debt!

- Create a budget for your household and stick to it!

:: Discover my Budgeting 101 Series HERE to tackle budgeting one step at a time–plus, you’ll get the details from my own personal budgeting journey!

The Personal Budget Spreadsheet

Need someone to walk you through budgeting? Check out the personal budget spreadsheet HERE that we’ve created for you. With easy-to-follow directions built in, it’s like having a personal financial planner guide you through the process. You really can learn how to do this!

“We buy things we don’t need with money we don’t have to impress people we don’t like.” ~Dave Ramsey

Your Household Budget

Get ready to find out exactly where your money is going when you map out your household budget like this. If you’ve never done this before, you may be surprised to see where your expenditures are really adding up. Most people that I talk to tell me they are floored to find out how much they are spending on food. That seems to be one of the biggest shockers. But here’s the good news: I have several free downloadable tools as well as articles that will help you learn how to save money at the grocery store.

:: Get started saving on your household budget HERE.

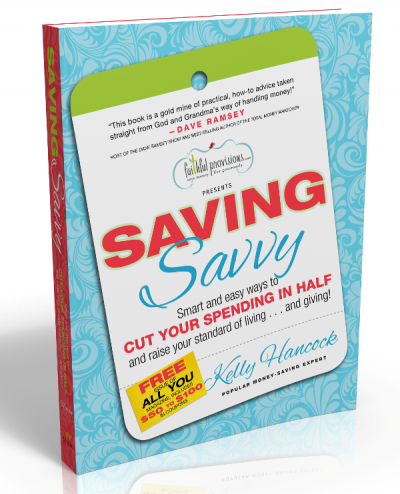

Whether you are new to couponing or a veteran, you’ll find tips and tricks you can use for saving even more money in my new book, Saving Savvy.

Whether you are new to couponing or a veteran, you’ll find tips and tricks you can use for saving even more money in my new book, Saving Savvy.

Kelly,

Thanks so much for teaching the class the other night. I really enjoyed it and learned a lot. I check your blog daily and think it is wonderful!

Blessings,

Amber

I LOVED YOUR CLASS THE OTHER NIGHT. I WENT TO THE NEW BELLE MEADE PUBLIX, SAVED $87.20 ON GROCERIES THANKS TO BUY 1/GET 1 FREE COUPLED W/ COUPONS…AND I HAVE A NEW BEST FRIEND CASHIER SUZI WHO WAS SO NICE AND PATIENT WITH ALL MY COUPONS AND EVEN ANNOUNCED HOW MUCH I’D SAVED TO THE PEOPLE IN LINE BEHIND ME! SHE TOLD ME ABOUT A SITE SHE LIKES CALLED SUZYCOUPON.COM BUT I HAVEN’T CHECKED IT OUT YET. THANKS SO MUCH! NOW, OFF TO GET THAT FREE COTTONELLE TP!

Tyler and I have been budgeting since we were first married, and let me tell you, it has cut down on our money fights! When we want to buy something, we always say “Put it on the budget!” Since Tyler is now self-employed, it is a little more difficult to stay on budget especially when income is tight. Budgeting monthly has helped us stretch our dollars because we know where every dollar is going. Most importantly, it keeps communication open in my marriage!

Kelly,

One idea that my husband and I did when trying to figure out our budget, was for three months I just recorded how much we ACTUALLY spent in each category. Then after the three months, we looked at each category and decided if that was a good budget or if we had spent too much in that category. One example may be gas for your car. If you don’t know accurately how much you spend a month in this category than this might be a good idea. Also, I looked at our groceries and averaged them for the three months to know how much to spend in this category. If we were not saving as much as we would like then I would look at where we could cut back to save more money. I know the area I struggle in is groceries. We do not eat out much, but I do not seem to be able to get our grocery bill under $250 a month for the two of us. It is an ongoing process.

Just wanted to throw that out there to help people figure out how much to budget in each area.

Love checking your blog for the deals!!!

One other question I had regarding this week’s class was whether anyone has done an inventory per se of rock-bottom prices around town. I get cutting coupons and two for one deals, but how low do chicken breasts, whole chickens, formulas, diapers go? What is the best way to know when things are on sale? I have three kids under age 4 so I don’t have any spare time to scout out Publix, Kroger, Target, Walgreen’s, CVS in any given week. For example…I was pricing whole chickens but I have no idea whether $4/lb is a good deal or highway robbery. Any thoughts?

I also appreciated the class! I have been doing e-Mealz for our family (of 5) meal plans since August. It has been a HUGE stress reliever for me because it takes away the questions “what’s for dinner”? The hard part I’m trying to overcome is how to save on all the “rest of the stuff”? For example, I budget $150 wk/. My meal plan might budget $75-85/wk but I end up spending almost double that when I’m at the checkout because of all the rest of the stuff (toiletries, milk, breakfast, etc.) So my question is: Once you have a budget and a meal plan, how do you incorporate the deals into your budget??????

I LOVE all the feedback here! In response to Jennifer’s question above…

When you first start shopping in the “stockpiling” mode, you begin to meal plan around what you have and what is on sale that week (sales flyers).

Then, you would allow a little extra in your budget (depending on your budget it could be from $10-50?) for only the “rock-bottom” deals. So, you have your needs list (for produce, dairy, necessities) which you try to base off of sales, then you have your stockpile/good deals list of things you may not need right now, but you will need later and it is a very good price right now, so you are going to get enough to get you through to the next sale.

As your stockpile grows over the course of 3-6 months, your “needs list” will begin to go down, and will be only things like dairy, produce etc. So, the things on your grocery list after 6 months-1 year will only be milk, eggs, grapes + the great deals this week. Because you have everything else in your pantry/freezer/fridge.

I hope this helps. Anyone else have some advice?

Another good question… Miller’s question on rock-bottom prices list. Oh, $4/lb for a whole chicken is HIGHWAY ROBBERY!!

As you begin to do this you will develop a knack for knowing your rockbottom prices on things. But, for the items you see as big budget breakers at the grocery (meats, cerealssheet, but if you go to the Aldi link on the left, there is a spreadsheet for prices at Aldi vs Walmart and that is a good place to start.

You can keep a small spiral notebook in your grocery bag and keep track when you find a good price. I know a lot of people have a spreadsheet. Can anyone help here?

For instance, here are a few of my rock bottom prices…

* Cereal $1-1.25/box

* Chicken Breasts $1.99/lb

* Whole Chicken $.49 – $.99/lb

* Pork Tenderloin $2.79/lb

* Ground Beef $1.99/lb

* Ground Turkey $.99/lb

* Tilapia $2.99/lb

* Diapers $5.99/package (sometimes much better w/ rebate programs)

I hope this helps, anyone else?

Miller, I also just found this link to getting started with your rock bottom price list, go here and see if it is helpful…

http://frugalhacks.com/2009/01/08/first-steps-to-creating-a-price-book-for-frugal-grocery-shopping/

Thanks for the tips. Very interesting to see the 99 cent price on ground turkey. I thought I was getting a good deal @ $2.29/lb at Costco, but I guess not!

Hi Kelly! Thank you so much for your blog! I have learned a ton in a few short weeks of reading and attempting to follow along! One big thing I’ve learned is to take the time (gets shorter each week) to make the lists and then shop with the coupons in hand. Just yesterday, our family saved $58 off a $99 grocery bill and I was thrilled! Not to mention my wonderful husband was blown away! He wanted to know my secret as he can’t walk in a store without robbing a bank with all he purchases! Thanks again! I look forward to continued savings and a happier family since I am already not so stressed out! Oh, and the holiday picture savings you did today was GREAT! We have already ordered 50 4×6 prints and it cost us $-0- and the shipping was free too! This is awesome!!

The website articles are great, only dropped in for a quick read and ended up reading a lot more. Thankyou and keep up the great feeds.

What other topics would you like to see covered on the blog? Let us know in the comments!

Test your timing and skills by playing the thrilling rhythm and platforming game geometry dash lite. For those who learn the basics, it offers countless hours of pleasure because to its difficult levels, great music, and addicting gameplay.

ciences frommás divertido que bet365 time to timmás divertido que bet365e. Dr Y.K. Smás divertido que bet365arin

This is such a helpful post! I love how you break down budgeting into simple steps. I definitely need to try that personal budget spreadsheet. Thanks for the tips! Internet Roadtrip

This is such a helpful article! I love how it breaks down budgeting into simple steps. I’m definitely going to check out that personal budget spreadsheet. Wish I found this sprunkr sooner!

Play Null’s Brawl for free with unlimited gems, new brawlers, and exciting skins. Download the latest version and enjoy fast-paced battles with no limits. Safe and easy to install.

Dreamy Room Game Guide – Complete Dreamy Room guide with walkthroughs for all 300+ levels. Get step-by-step text guides, visual images, and video tutorials for this relaxing unpacking puzzle game.

Transform your ideas into high-quality AI-generated images and videos with Tiepolo AI’s powerful technology. Create stunning visual content with simple text prompts – completely free to start. No design skills needed.tiepolo ai

The magic of Sprunki? It turns abstract composition into Sprunki tangible character relationships you can see and feel evolve.

I totally agree—the spending on food is always the biggest surprise when people finally sit down and map out their budgets; it’s insane how quickly those daily purchases add up! It’s fantastic that you have those free downloadable tools and articles available right there, because that immediate solution is exactly what people need after the initial shock of seeing where their money has been going wears off.

This article offers such practical and encouraging advice on budgeting! For parents looking to combine saving money with educational fun, I highly recommend checking out these math games that help kids build essential skills while having a great time.

I had a great time playing space waves unblocked. It’s fast, entertaining, and very easy to join quick online matches.

Your story about finding freedom through budgeting resonates deeply. It’s inspiring how you turned desperation into discipline and peace of mind. Thanks for the practical steps and encouragement! Eager to explore more tools at Stuidioify.

I loved with Stickman Hook, fun and great for brief games.

It turned out that Shadybears was very enjoyable, fast-paced, and easy for newcomers.

Moto X3M Unblocked actually turned out to be enjoyable, fast-moving, and simple for beginners.

Playing Shady Bears always puts me in a good mood. The controls are quick and the game feels lively. Great for short sessions when you want something light.

If you’re into simple racing games that don’t need downloads, try Poly Track Unblocked. It’s light, fun, and works right in your browser.

I’m into the classic arcade style of Ping Pong Go; it works great for quick breathers.

I love how the game keeps you focused with fast pacing and unexpected obstacles. Try the complete experience at run 3 unblocked and see how far you can go.

It turned out that Poly Track was quite amusing, rapid, and welcoming to beginners.

Looking for a game with high-octane combat and incredible visuals Monkey Mart

pips game It took me a little while to read all of the comments, but I found the article to be quite intriguing.

Rogue Piece Embark on the ultimate pirate adventure by visiting Rogue Piece, where you can access the latest active codes, detailed devil fruit tier lists, and leveling guides to become the strongest captain on the high seas.

Stickman Hook Unblocked is super fun and addictive. I love trying to swing farther and avoid obstacles, and every run feels exciting and challenging.

The soundtracks are phenomenal! ABCya3 make every fight feel epic.

Ping Pong Go lore and story are surprisingly deep, mixed with some fantastic dark humor.

If you love fast-paced, Drift Boss

Looking for active Forge Roblox codes? Get free Rerolls, Miner Totems, and rewards with our daily updated list.

This is a solid reminder that discipline and planning matter, whether it’s money or time in a game.

Built around precision and timing, the game guarantees fast-paced action with zero boredom. Head to Basketball Stars to play the full game and see how far you can push your score. https://basketballstarsgame.net/

Featuring easy-to-learn controls and progressively harder challenges, the game offers a satisfying drifting experience. Try the full version at Drift Boss and refine your timing and accuracy.

What makes the game exciting is its immersive feel, particularly at higher speeds. Enjoy the complete adventure at Space Waves and test your limits.

Stop reading this and go play Basketball Stars. Seriously, it’s a masterpiece.

Put this down and start playing A Small World Cup. No joke, it’s incredible.

I totally relate to learning budgeting out of necessity! It’s amazing how saving in one area can free up funds for others, like trying new styles without overspending. Tools like swap outfits could help fashion lovers experiment affordably.

Enough reading, it’s time to play level devil. It’s that good.

Drop everything and play Iron Snout. I’m not kidding, it’s brilliant.

I LOVED YOUR CLASS THE OTHER NIGHT. I WENT TO THE NEW BELLE MEADE PUBLIX, SAVED $87.20 ON GROCERIES THANKS TO BUY 1/GET 1 FREE COUPLED W/ COUPONS… AND I HAVE A NEW BEST FRIEND CASHIER SUZI…

Head to https://glidein.org for Glide In—this 3D skill puzzle game lets you drag, aim, and sink the puck! Dodge red walls, use green bounce pads, and seize 3 chances per challenge for addictive fun!

Visit https://fun-clicker.com for Fun Clicker—tap the happy green character to earn points in this addictive idle game! Unlock upgrades, fun skins, and chase the secret final reward for endless cheerful clicking joy!

Visit https://dragon-traveler.wiki—the ultimate Dragon Traveler resource! Master combat, explore its magical Isekai world, unlock all endings, and grab redeem codes for epic rewards on your rom-com RPG journey!

Dive into chaos at https://fevermeme.online! Fever Meme, the genre-shifting comedy parody, mocks traditional design with internet culture, rage mechanics, and meta-narratives—prepare for fourth-wall-breaking fun!

Thanks for this well-written and informative post on Jalwa Game Login. The explanation is simple, clear, and very helpful for both new and existing users. I really appreciate how you covered the login steps and possible issues in an easy way. This guide will surely help players avoid confusion and access their accounts smoothly. Keep sharing more useful content like this.

Thanks for sharing your story on Budgeting and Saving Money! I really related to how you learned to budget out of necessity and desperation. It’s tough when you’re forced to figure it out that way, but your perspective is so valuable for anyone currently struggling with their finances.

Thank you for sharing such valuable and well-organized information. The blog is easy to read and very helpful for beginners and experienced readers alike. I truly appreciate the effort behind this content. For those who enjoy online entertainment, I highly recommend checking out Okwin Gaming. It offers a smooth interface, exciting features, and a secure platform that makes the gaming experience enjoyable and reliable.

Thank you for sharing this wonderful and informative blog post. I truly appreciate the effort you put into explaining everything so clearly. It was easy to understand and very helpful. I would also like to recommend Okwin Lottery to readers who are looking for an exciting online gaming platform. It offers a smooth experience and great features. Keep posting such valuable and engaging content.

Thank you for sharing such an informative and well-written blog post. I really appreciate the clear explanation and useful details you provided. It helped me understand everything in a simple way. For anyone looking for a smooth and secure gaming experience, I highly recommend using okwin login for easy access and quick account management. Keep posting more helpful content like this. Great work and thanks again for the valuable information!

Great article, thanks for sharing! The step-by-step explanation of the Big Mumbai Login makes the entire process simple and stress-free. I liked how you highlighted important points that users usually miss. This kind of detailed yet easy content is very helpful for readers looking for reliable guidance. Looking forward to reading more informative posts like this from you.

Thank you for explaining the benefits of Mukhyamantri Abhyudaya Yojana and Pradhan Mantri Kaushal Vikas Yojana so clearly. These schemes support students and unemployed youth with the right tools for success. Free coaching and skill development are powerful opportunities. Truly an inspiring and valuable post!

I am grateful for this comprehensive overview of Mukhyamantri Abhyudaya Yojana and Pradhan Mantri Kaushal Vikas Yojana. Both initiatives play a key role in empowering youth with education and practical skills. They foster confidence, employment, and financial stability. Such government efforts are shaping a brighter future.

Wow, that $87.20 saved is amazing! On my commute, Dave Ramsey’s money direction idea really hit me; Budgeting 101 looks crucial for my freedom.

While on the surface a simple pastime, Scrabble has subtly shaped modern society by sharpening essential cognitive skills. It is more than a game; it is a daily mental workout that challenges players to perform rapid-fire vocabulary recall and complex strategic calculations. This constant engagement with words enhances linguistic dexterity and reinforces the richness of the English language in an entertaining format. Furthermore, Scrabble fosters critical thinking, patience, and sportsmanship in social settings, from family homes to international clubs. By transforming the building blocks of communication into tools for friendly competition, Scrabble has helped keep language vibrant and minds agile across generations.

Space Waves is a brilliant online game that delivers nonstop action and colorful entertainment.

You have done a great job on this article. It’s very readable and highly intelligent.